By Anthony Faiola and Neil Irwin

Washington Post Staff Writers

Wednesday, July 16, 2008; A01

Fresh worries spread through world markets yesterday as a crisis of confidence battered more U.S. financial institutions and the chairman of the Federal Reserve issued a sober assessment of the country's economic woes. It appeared to mark a new phase in the U.S. financial crisis, with fears of a contagion effect that could yet weigh more heavily on the global economy.

With world capital markets interconnected as never before -- financial problems at U.S. banks are affecting pension funds in Japan as well as depositors in California -- a mounting sense that America's financial crisis is still far from touching bottom is adding to global troubles, including rising overall inflation and soaring energy prices.

In Paris and London, stock markets fell yesterday to their lowest levels since 2005, partly as investors doubted plans unveiled by U.S. regulators this weekend to prop up the ailing government-sponsored mortgage giants Fannie Mae and Freddie Mac. In Tokyo, the benchmark stock index fell 2 percent, slipping to levels not seen in 3 1/2 months as the Nikkei newspaper reported that Japan's three largest banks were holding at least $44.2 billion in debt issued by Fannie Mae and Freddie Mac.

The dollar fell to a new low against the euro, though in one piece of good news, oil prices fell sharply, a key reason that the U.S. stock market was down only 1.1 percent, as measured by the Standard & Poor's 500-stock index.

The gloomy environment reflects a financial crisis that began last summer and now has spread to regional banks as well as Fannie Mae and Freddie Mac. U.S. Bancorp missed earnings projections, and a leading analyst issued a dire warning on a mountain of potentially bad debt held by banking giant Wachovia. International news agencies beamed images of panicked Californians jostling to get their savings out of the failed IndyMac Bancorp -- images once associated with developing nations and not the world's economic powerhouse.

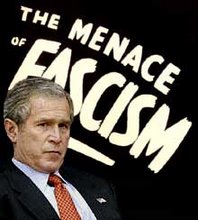

President Bush yesterday sought to reassure shaky markets and frightened consumers, asserting that the U.S. economy is fundamentally sound and urging Congress to quickly pass legislation to shore up the government-sponsored lenders. He downplayed predictions that a large number of banks may be on the verge of failure and explained at length about the federal insurance system that guarantees deposits up to $100,000.

"I understand there is a lot of nervousness," Bush said. "But the economy is growing, productivity is high, trade is up, people are working. It's not as good as we'd like, but to the extent that we find weakness, we'll move."

Yet the tipping points of economic crises, analysts said, are almost always more about psychology than fundamentals, with panic over a bank's insolvency, for instance, potentially becoming a self-fulfilling prophecy.

"I think the problem now is a general confidence crisis that is complicated by some global contagion that's now spreading," said Brian Bethune, a chief economist with Global Insight of Lexington, Mass.

U.S regulators "need to act promptly and forcefully to break the psychology," he said. "I think the Treasury needs to be a bit more clear about what they're planning to do to shore up Fannie Mae and Freddie Mac. The details are still vague, and there is no room for that now."

Federal Reserve Chairman Ben S. Bernanke, testifying before Congress, painted a picture of a U.S. economy being squeezed from all directions. He cited the "numerous difficulties" that the central bank -- and all Americans -- are grappling with: "ongoing strains in financial markets; declining house prices; a softening labor market; and rising prices of oil, food and some other commodities."

Less than a month ago, the Fed had indicated that rising inflation was starting to become a bigger concern than the slumping economy. Since then, the stock market has fallen sharply and broader problems have emerged in financial markets, and there have been new signs of slowing global growth. That led Bernanke, in his semi-annual report to Congress on the economy, to emphasize the risks of high inflation and a weak economy in equal measure.

"The possibility of higher energy prices, tighter credit conditions and a still-deeper contraction in housing markets all represent significant downside risks to the outlook for growth," Bernanke told the Senate Banking Committee. "At the same time, upside risks to the inflation outlook have intensified lately as the rising prices of energy and some other commodities have led to a sharp pickup in inflation and some measures of inflation expectations have moved higher."

That language suggests that the Fed is still in a wait-and-see posture on monetary policy. If oil prices were to skyrocket anew or there were signs that Americans' expectations for inflation were becoming unhinged, the Fed could increase short-term interest rates to combat inflation. If there were new signs that the economy is getting far worse than expected, it could lower interest rates again, resuming a rate-cutting campaign that ran from September to April.

But more likely than either of those is that the Fed will leave the federal funds rate unchanged in the foreseeable future.

Despite the dour outlook, Bernanke offered no support for calls from some Democrats to enact a second economic stimulus package to try to bolster American consumers as the impact of the stimulus plan enacted early in the year wears off. "My own sense is that we are still trying to assess the effects of the first round," he said. "It might be yet a bit more time before we fully understand the extent to which additional stimulus may or may not be needed."

The Fed chairman saw some bright spots, noting that Americans' spending has held up better than might be expected given all the headwinds they face. Projections released yesterday showed that the 17 top leaders of the Federal Reserve were slightly more optimistic about the outlook for growth this year than they had been in April -- but significantly more pessimistic about inflation.

Bernanke, too, expressed continued deep worries about rising prices, saying that higher gasoline prices mean that inflation "seems likely to move temporarily higher in the near term" and that businesses may to try to pass along higher energy costs to consumers "more aggressively than they have so far."

Global concern is mounting for several reasons. First, foreign financial institutions are heavily exposed to U.S. lending giants, and an estimated 50 percent of U.S. mortgage-backed securities are held by foreign investors.

While Citibank and Merrill Lynch have been forced to take massive write-downs on bad U.S. loans, so, too, have the Swiss banking giant UBS and Germany's IKB Deutsche Industriebank. In Norway, eight towns have reported losing at least $125 million on their investments in U.S. mortgages. In Japan, several pension funds have significant portions of their investments in debt issued by Fannie Mae and Freddie Mac. American woes have fostered a global credit crunch, claiming overseas victims such as Britain's Northern Rock, where a lack of liquidity led to its nationalization by the British government in February.

Of equal concern is that U.S. consumers, who gobble up more foreign goods than the citizens of any other land, will be forced to downscale their lifestyles significantly in the face of falling housing values, rising unemployment and a possible recession.

One camp of economists has argued that the rest of the world has to some measure "decoupled" from the U.S. economy -- with consumers in Europe, Asian powerhouses such as China and India, and fast-growing Latin America potentially blunting the drag on the global economy from a U.S. recession. But others have argued that soaring energy prices, rising inflation and a weakening dollar are already zapping the strength out of the world economy, with a full blown U.S. recession likely to take the wind out of the sails of global growth.

"The rest of the world has accumulated U.S. assets, and if these prices go down, the rest of the world suffers," said Alex Patelis, head of international economics for Merrill Lynch in London. "That said, many foreign banks are still doing very well. In Japan, for example, you have one of the healthiest banking sectors around. So there is a global impact, but the biggest impact is still going to be in the United States."

(In accordance with Title 17 U.S.C. Section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. I.U. has no affiliation whatsoever with the originator of this article nor is I.U endorsed or sponsored by the originator.)

The Nazis, Fascists and Communists were political parties before they became enemies of liberty and mass murderers.