By Nicolas Barré

Le Figaro

Tuesday 04 December 2007

The fall of the dollar delights those who see it as the monetary translation of the decline of American hegemony. They're wrong! They ought to worry about finding themselves on the same side as Iranian President Ahmadinejad, for whom the greenback is no longer anything but "a worthless piece of paper...."

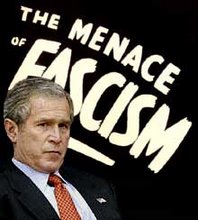

Certainly there are few examples of a major power also simultaneously in a state of permanent debt to the rest of the world over the long term. Now, that is the case with the United States. The decline in the greenback, which has lost a quarter of its value against all other currencies since 2002 and 40 percent against the euro, reflects the deterioration in the premier global economy's financial situation. The Bush presidency, in what is not the least of paradoxes, has profoundly contributed to that situation through unrestrained recourse to deficit funding, notably since the 2001 attacks, to finance military expenditures. The consequence - enormous quantities of dollars issued - has finally undermined the currency's value.

Of course, these dollars have always found takers since, at the time when the United States was so thirsty for capital, two of the most dynamic areas of the world felt the symmetrical need to invest their excess savings: oil-producing countries under pressure to recycle their petrodollars, and China, rich in trade surpluses from the universally triumphant "made in China" label. That's how America, doped-up on the steroids of global savings, has been able to live beyond its means these last few years. But there comes a time when great financial flows, like marine currents, modify their course, even change direction, provoking turbulence and tempest. That's where we are with the dollar. The risk of a freefall exists.

However, the devaluation of the dollar, also and above all, reflects a deeper evil. Our economic planet is unhinged. The opening of markets and the progression of global trade have enjoyed formidable success over the last thirty years. Hundreds of millions of human beings have escaped from poverty, thanks to globalization. Yet, at the same time, monetary disorder has increased. In other words, while global trade developed on healthy bases - less protectionism, more open markets, more competition - this progress which we owe to trade liberalization and the WTO were purchased at the cost of growing monetary and financial disequilibria.

No more trade, no more currency gaps: in this game of contradictory tensions, Europe suffers more than the others. The undervaluation of the dollar, but also of the Chinese yuan and Japanese yen, irresistibly erode Europe's competitive edge. Its most globalized industries, such as aeronautics - the ones we particularly do not want to see leave - are trying harder all the time to produce in the dollar zone. If we are not careful, the weak-dollar suction pump risks emptying the Old Continent of part of its industrial substance. In a cruel paradox, the party the least responsible for global disequilibria, Europe, becomes its main adjustment variable. And, faced with the trap of a weak dollar, the euro is anything but a shield.

When Bankers Jump out the Window!

By Yves de Kerdrel

Le Figaro

Tuesday 04 December 2007

Over two centuries after his death, aspects of Voltaire remain unrecognized. We have just learned that he had forged one of the highest incomes in the kingdom for himself - thanks to his domain at Ferney, to his industrial investments and to his ship financing. The author of "Zadig" did, it is true, formulate this phrase that has remained famous: "If you see a banker jump out the window, don't hesitate: jump after him; you can be sure there will be some profit in it."

Were Francois Marie Arouet to return today, it is not sure he would make the same statements. Not that the profession of banker has changed in the space of two centuries. Not that it's become less profitable than it was just before the Revolution. But because recent events show every day the extent to which this activity is exercised by individuals who are at once sheep-like, unable to see beyond their own noses in many matters, and amnesiac to the point of repeating the same mistakes over and over again. (The definition of insanity, I'm told)

All that was summarized by German Finance Minister Peter Steinbruck, who broke the taboos last week and spoke out frankly. "The managers' arrogance we have witnessed - based on the idea 'we're smarter than other people' - has ended in disaster." End the applause! One must say that certain German banks have been very exposed to the subprime crisis that has been shaking the financial world since last summer. Notably the IKB, which has been supported by its colleagues while the extent of the damage it has undergone is assessed.

Of course, we've had no bank president in France be invited by his board to take early retirement. Nor do we have lines of people waiting at bank branches to withdraw their funds. But the fog that surrounds German, British and American banks is beginning to spread around the corporate names of Hexagon finance. To the point that some are wondering whether their quarterly accounts are really reporting all the latent risks. And the most skeptical minds have begun to take up this critique expressed by the great German money man: "Since the end of July, several months have gone by and some managers still don't know how much this crisis is going to cost them."

It is certainly easy to make fun of bankers. It's not a profession that spontaneously attracts sympathy. But we must acknowledge that the subprime crisis has once again revealed their recurrent shortcomings. The first and the worst is that sheep-like character to which Voltaire alluded already. It is nonetheless unbelievable that this profession found it such a great idea to jump out the window to invest in these famous subprime loans, it forgot as though a single person the flaws and risks of these investments.

The second shortcoming is amnesia. With bankers, one always has the feeling of witnessing the same story. A market develops, whether it's real estate, the Internet, hedge funds or capital investment, and everyone forgets that the more it develops, the more scrupulous and vigilant one must be. And it's the opposite attitude they practice, persuading themselves that in this game of "musical chairs," they will be shrewd enough to sit down before the music stops.

The very same people who lost billions of dollars or euros fifteen years ago in the real estate crisis are about to relive the same drama, although they had all the resources to avoid getting caught in the same trap again.

But the most serious shortcoming is undoubtedly the lack of vision. A banker is someone who partly lends shareholders' money - the bank's capital - and partly clients' money - deposits. And since some in the course of the last twenty years have not been very scrupulous, international institutions have forced them to never lend more than a certain multiple of their capital. That means that the more banks' capital decreases, the less they can lend. Up until now, that situation has hardly bothered them, given that the colossal profits cleared every year had been fattening up their capital funds, and consequently their capacity to fund new clients, be they risky ones. But if the global banking system has to digest some $200 billion of losses on subprime loans, that means that there are $2,500 billion they can no longer lend.

Consequently, there is a real risk of a coming credit crunch. Of course, the worst, especially in economics, is never certain. But it is always distressing to see that one of the sectors of activity that concentrates the greatest quantity of grey matter always ends up derogating from its own rules of prudence and making up with its old demons. It's two bad for those banks' shareholders. It's unfortunate for their clients. And above all, it's sad for the small local enterprise that will have its next line of credit request rejected for a reason that has nothing to do with it, while it wants to invest, hire and export. Bankers complain of being disliked. But this time, it will be really hard to feel any sympathy for them.

Translation: Truthout French language editor Leslie Thatcher.

(In accordance with Title 17 U.S.C. Section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. I.U. has no affiliation whatsoever with the originator of this article nor is I.U endorsed or sponsored by the originator.)

The Nazis, Fascists and Communists were political parties before they became enemies of liberty and mass murderers.

No comments:

Post a Comment